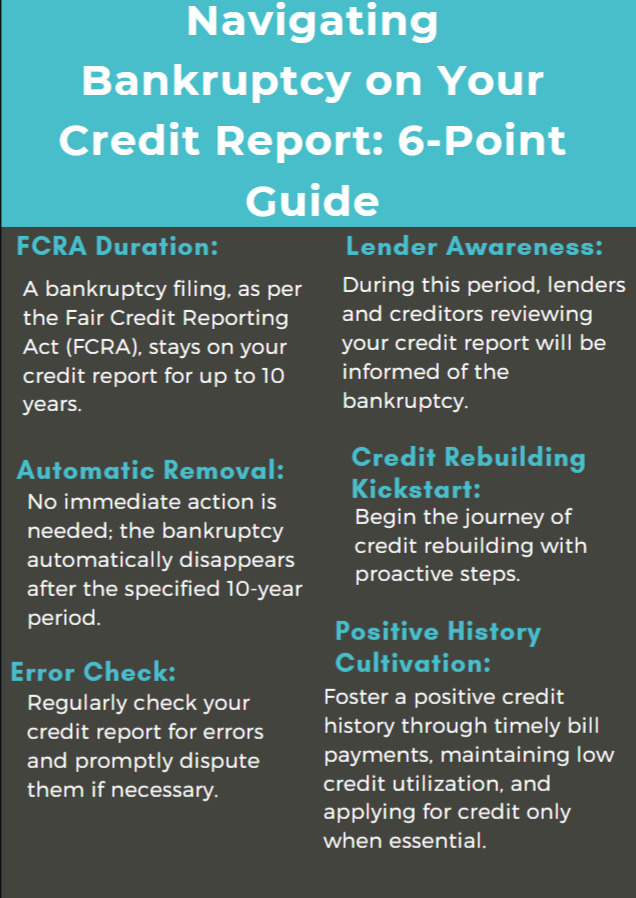

It’s important to note that you don’t need to take any action to remove a bankruptcy from your credit report since it will automatically be deleted seven or ten years from the filing date, depending on the type of bankruptcy.

If you’re looking to rebuild your credit after bankruptcy, you can start by checking your credit report for errors and disputing them if necessary.

You can also work on building a positive credit history by paying your bills on time, keeping your credit utilization low, and applying for credit only when necessary.

How long does bankruptcy stay on your credit report?

Under the Fair Credit Reporting Act (FCRA), a bankruptcy filing can linger on your credit report for up to 10 years.

During this period, lenders and creditors reviewing your credit report will be aware of the bankruptcy.

Remember, there’s no need for immediate action to remove the bankruptcy; it automatically disappears after the specified time.

To kickstart credit rebuilding:

- Check your credit report for errors and dispute them if necessary.

- Foster a positive credit history by timely bill payments, maintaining low credit utilization, and applying for credit only when essential.

Your journey to credit recovery is a gradual process; take proactive steps for a brighter financial future.

How to rebuild credit after bankruptcy?

If you’re looking to rebuild your credit after bankruptcy, there are several steps you can take to improve your credit score. Here are some tips:

- Check your credit report for errors: Make sure your credit report is accurate and up-to-date. If you find any errors, dispute them with the credit bureau.

- Practice responsible credit habits: Pay your bills on time, keep your credit utilization low, and apply for credit only when necessary. These habits will help you build a positive credit history.

- Consider a secured credit card: A secured credit card can help you rebuild your credit by allowing you to make small purchases and pay them off in full each month. Make sure to choose a card with low fees and a low interest rate.

- Apply for a credit-builder loan: A credit-builder loan is a type of loan that is designed to help you build credit. You borrow a small amount of money and make regular payments over a set period of time. Once you’ve paid off the loan, you’ll have a positive credit history.

- Become an authorized user on someone else’s credit card: If you have a friend or family member with good credit, ask them to add you as an authorized user on their credit card. This can help you build credit without taking on any debt.

How to dispute errors on your credit report?

If you spot a mistake on your credit report, kick off the correction process by disputing the information with credit reporting companies (Experian, Equifax, and/or Transunion).

Craft a written explanation of the error, reasons for your dispute, and include supporting documents.

Utilize the Consumer Financial Protection Bureau (CFPB) instructions and template for guidance.

Remember these key steps:

- Maintain copies of your dispute letter and accompanying documents.

- Opt for certified mail with a return receipt for a documented delivery record.

Concerned about identity theft? Navigate to IdentityTheft.gov, the federal government’s comprehensive resource to report and recover from identity theft.

Your journey to accurate credit reporting begins with these proactive measures.

How to improve your credit score?

Ensure the accuracy of your credit report: Confirm that your credit report is precise and current. If you spot any inaccuracies, challenge them with the credit bureau.

Timely bill payments matter: Late payments can adversely affect your credit score. Set up automatic payments or use reminders to stay on track.

Manage credit utilization wisely: Keep your credit utilization under 30%, balancing the credit you use with your limit.

Apply for credit judiciously: Avoid negatively impacting your credit score by applying for credit only when necessary.

Explore secured credit cards: Building credit is possible with a secured credit card; choose one with minimal fees and a low interest rate.

Leverage someone else’s good credit: Consider becoming an authorized user on a friend or family member’s credit card to build credit without taking on debt.

Retain old credit accounts: The length of your credit history influences your credit score, so if you have well-maintained old credit accounts, consider keeping them open.

How to get a free credit report?

Obtain a complimentary credit report annually from each of the three major credit bureaus – Equifax, Experian, and TransUnion – by visiting AnnualCreditReport.com.

Additionally, if you’ve faced credit denial, employment rejection, or insurance refusal in the past 60 days, you can request a free credit report.

When seeking your free credit report, furnish details like your name, address, Social Security number, and date of birth.

Additional information may be required for identity verification.

Regularly reviewing your credit report is crucial to spot errors and potential identity theft indicators.

In case of any discrepancies, initiate a dispute with the credit bureau.